child tax credit november 2021 not received

If you became eligible in 2021 for example because of the birth or adoption of a qualifying child but didnt receive advance Child Tax Credit payments for that qualifying child you may claim the full amount of your allowable Child Tax Credit for that child when you file your 2021 tax return. 15 to sign up to receive a lump sum of up to 1800 for.

Did Your Advance Child Tax Credit Payment End Or Change Tas

So parents of a child under six receive 300 per month and parents of a child six or over receive 250 per.

. IR-2021-222 November 12 2021. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families will soon receive their advance Child Tax Credit CTC payment for the month of November. Half of the total is being paid as six monthly payments and half as a 2021 tax credit.

At first glance the steps to request a payment trace can look daunting. Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6 through 17 for 2021. November 12 2021 1226 PM CBS New York.

If youre eligible but did not receive any monthly advance Child Tax Credit payments in 2021 you can still get a lump-sum payment by claiming the Child Tax Credit on your 2021 federal income tax return filed during the 2022 tax filing season. Eligible families who did not receive advance payments can claim the Child Tax Credit on their 2021 federal tax return to receive missed payments and the other half of the credit. The advanced Child Tax Credit payments are due out on the 15th day of each month over the second half of 2021 meaning that November 15.

If you have confirmed that you reported your information correctly in the TaxAct program you will want to contact the IRS at the number provided to find out why the IRS is not allowing you the full amount of this. Thanks to the 2021 American Rescue Plan Act the 2021 Advance Child Tax Credit CTC is available to help NYC families afford the everyday expenses of raising a child throughout the COVID-19 pandemic. The Child Tax Credit Update Portal is no longer available but you can see your advance payments total in your online account.

Determine if you are eligible and how to get paid. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per. CBS Baltimore -- The fifth Child Tax Credit payment from the Internal Revenue Service IRS will be sent this coming Monday.

But many parents want. November Child Tax Credit Payments Coming Soon Nov. Click the Other Credits dropdown then click Child tax credit.

If you have a baby anytime in 2021 your newborn will count toward the child tax credit payment of 3600. 2021 Child Tax Credit and Advance Payments. This final batch of advance monthly payments for 2021 totaling about 16 billion will reach more than 36 million families across the country.

If you have children 17 years of age or younger and have not received advance CTC payments this year you may be able to claim half of your annual CTCworth up. Continue with the interview process to enter your information. Children who are adopted.

14 2021 Low-income families who are not getting payments and have not filed a tax return can still get one but they must sign up on IRSgov by 1159 pm Eastern Time on Monday Nov. You may also be eligible to claim other credits on your 2021 federal income tax return. Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers.

Low-income families who have not received advance payments because they do not typically file a tax return have until Monday night Nov. The Child Tax Credit provides monthly payments to families even those who do not file taxes or earn an income. Low-income families who are not getting payments and have not filed a tax return can still get one but they.

Check mailed to a foreign address.

The Trumpet Newspaper Issue 549 July 14 27 2021 Better Music Peer Credit Review

Turbotax Deluxe Online 2019 Maximize Tax Deductions And Tax Credits Tax Deductions Tax Credits Turbotax

Passion Your Calling Entrepreneur Quotes Entrepreneur Inspiration Entre Inspirational Quotes For Entrepreneurs Inspirational Quotes Spirituality Energy

Banking Financial Awareness 19th December 2019 Awareness Financial Banking

Didn T Get Your Child Tax Credit Here S How To Track It Down Gobankingrates

Missing A Child Tax Credit Payment Here S How To Track It Cnet

Banking Awareness Of 10 11 And 12 December 2021 Awareness Banking Indusind Bank

Enroll Now For June 1 2021 Coverage Affordable Health Preventive Care Health Plan

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Daily Banking Awareness 8 9 And 10 November 2020 Awareness Banking Financial

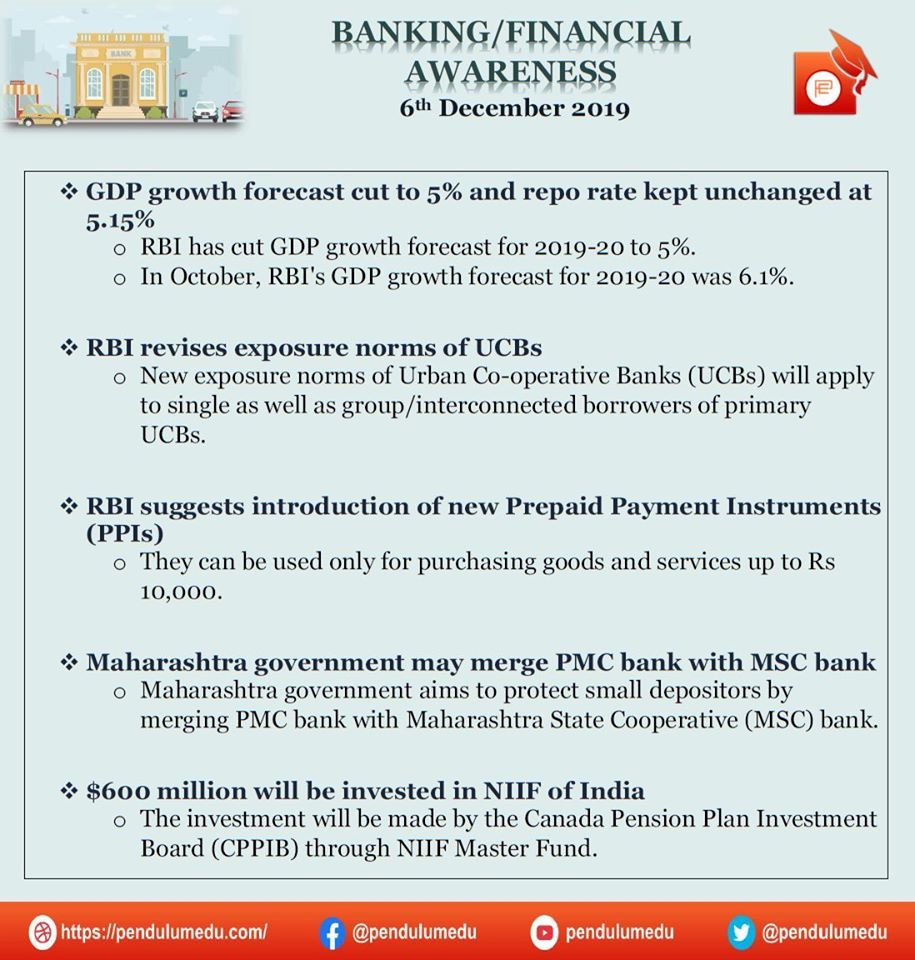

Daily Banking Awareness 06 December 2019 Awareness Financial Banking

Fy 2020 21 Ay 2021 22 Itr Forms For Salaried Individuals Other Income Sources Which Itr Form To Download File Itr Online Tax Filing System Filing Taxes Indirect Tax

Tds Due Dates October 2020 Dating Due Date Income Tax Return

Business News India Latest India Business News Headlines Today 29 November 2021 In 2021 News India Today India News India

2021 Child Tax Credit Advanced Payment Option Tas

Top Stock Brokers In India List Of 5 Best Stock Brokers In India 2021 Stock Broker India Best Stocks

A Brief Reflection On Lessons From Asia For Ghana Noelle Wonders In 2021 Lesson Reading Reflection